To keep our members up-to-date on available resources and the Chamber response to Covid-19, for the foreseeable future the Worcester Regional Chamber of Commerce will issue emails at noon. These emails will contain a variety of information from local, state, and federal loans to the offerings of local businesses and best practices during this uncertain time.

#45 | Thursday, June 4, 2020 | Senate Approves PPP Bill, Outdoor Dining Guidance for Worcester Restaurants, Events

Senate Approves House Version of Payroll Protection Program

Changes Should Help Small Business Owners with Loan Forgiveness

The U.S. Senate passed the House version of Paycheck Protection Program (PPP) legislation last night, tripling the time allotted for small businesses and other PPP loan recipients to spend the funds and still qualify for forgiveness of the loans.

• PPP borrowers can extend the eight-week period to 24 weeks, or can keep the original eight-week period. This flexibility is designed to make it easier for more borrowers to reach full, or almost full, forgiveness.

• The payroll expenditure requirement drops to 60% (from 75%) but is now a cliff, meaning that borrowers must spend at least 60% on payroll or none of the loan will be forgiven. Currently, a borrower is required to reduce the amount eligible for forgiveness if less than 75% of eligible funds are used for payroll costs, but forgiveness isn’t eliminated if the 75% threshold isn’t met.

• Borrowers can use the 24-week period to restore workforce levels and wages to the pre-pandemic levels required for full forgiveness. This must be done by Dec. 31, a change from the previous deadline of June 30.

• The legislation includes two new exceptions allowing borrowers to achieve full PPP loan forgiveness even if they don’t fully restore their workforce.

• Previous guidance already allowed borrowers to exclude from those calculations employees who turned down good faith offers to be rehired at the same hours and wages as before the pandemic.

• The new bill allows borrowers to adjust because they could not find qualified employees or were unable to restore business operations to Feb. 15, 2020, levels due to COVID-19 related operating restrictions.

• Borrowers now have five years to repay the loan instead of two. The interest rate remains at 1%.

The bill allows businesses that took a PPP loan to also delay payment of their payroll taxes, which was prohibited under the CARES Act.

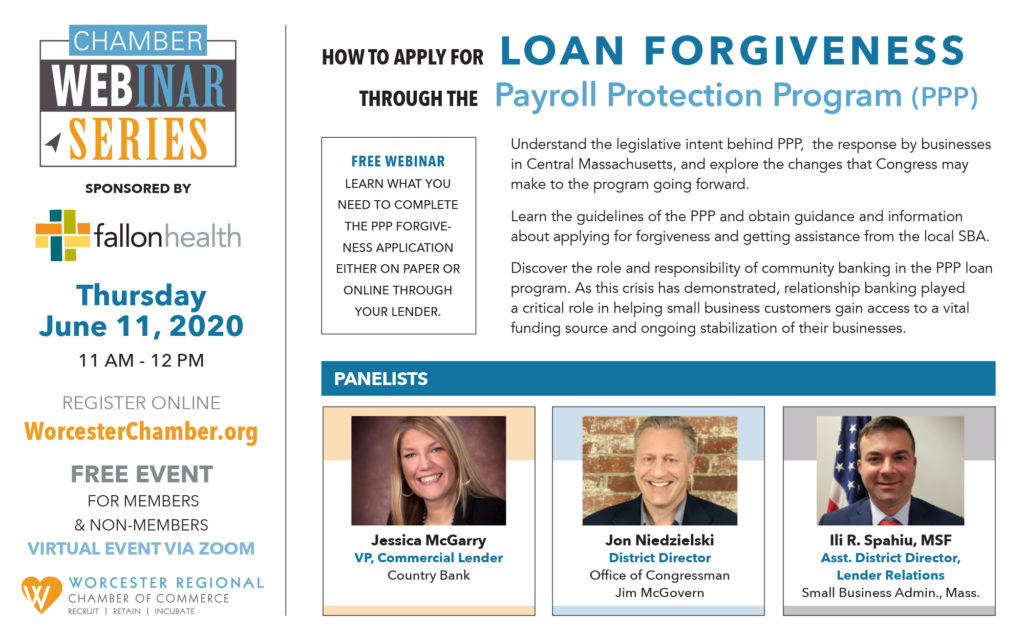

IMPORTANT: See PPP forgiveness webinar information below to register for this free, informational session to help you through the process.

FOR RESTAURANT OWNERS AND OPERATORS

Worcester’s Outdoor Dining Guidance and Technical Assistance Meeting

The City of Worcester and the Worcester Regional Chamber of Commerce will co-host a Zoom call for restaurant owners who have questions about outdoor dining guidelines and application. The call will take place on Friday, June 5 from 12 noon to 1 pm. This meeting is free and open to all.

Staff from the City’s Economic Development Office, Planning Division, and Law Department will participate to answer questions.

Registration is required. If you have any questions or are having trouble registering please contact: Peter Dunn, Chief Development Officer, City of Worcester at OutdoorDining@worcesterma.gov

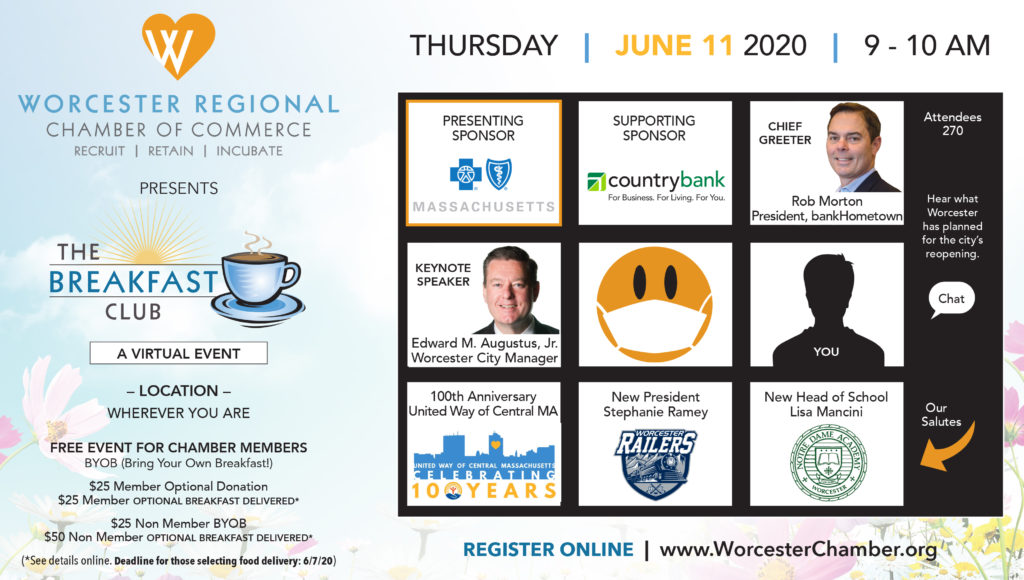

UPCOMING CHAMBER EVENTS

#44 | Wednesday, June 3, 2020 | Reopening Guidelines, Executive Order, Statement About George Floyd

Governor Baker Issues Executive Order RE: Phases, II, III, IV

The governor’s office has provided a detailed list of businesses and activities that fall into Phases II, III, and IV of the Commonwealth’s Reopening Plan.

The Order also permits all Phase II enterprises, including retail, to begin preparations to safely resume operation in advance of the start of the second phase. In addition to the retail sector, the Order details requirements for the safe resumption of amateur youth and adult sports and outdoor dining.

Effective immediately, the Order permits Phase II businesses to reopen their physical workplaces to workers only to conduct necessary preparations prior to the start of Phase II. Preparations include but are not limited to completing a COVID-19 Control Plan, implementing sector-specific protocols, and complying with Mandatory Workplace Safety Standards.

Restaurant Reopening

The Executive Order permits restaurants to provide outdoor dining service with restrictions upon the start of Phase II; providing continued positive progression of public health data, indoor dining may be authorized by a subsequent order during Phase II.

In order to provide improved opportunities for outdoor table service, the order also provides flexibility to a local licensing authority to grant approval for a change for any type of license that permits the sale of alcoholic beverages for on- premises consumption. In both outdoor and indoor dining cases, restaurants will be required to comply with sector-specific COVID-19 workplace safety rules for restaurants.

VIEW Industry Sector Specific Protocols

ICYMI…

Statement About the Murder of George Floyd

Yesterday, June 2, Chamber CEO,Tim Murray and board chair Bob Cox, issued a joint statement about the murder of George Floyd published in its entirety below.

Statement of:

Timothy P. Murray, President and CEO, Worcester Regional Chamber of Commerce

Robert D. Cox, Jr., Chair, Board of Directors, Worcester Regional Chamber of Commerce and Managing Partner, Bowditch & Dewey

Like so many this past week, at the Chamber we have been distraught by the murder of George Floyd in Minneapolis.

His murder is counter to the fundamental concepts on which our country was founded. Concepts embodied in the words of the Declaration of Independence that state “we hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain inalienable Rights, that among these are Life, Liberty and the pursuit of Happiness.’” As Dr. Martin Luther King, Jr. said, if we are to “rise up and live out the true meaning of its creed” our nation must do better to ensure these rights are available to all Americans, regardless of race, gender, religion, or sexual orientation.

As an organization that has played a prominent role in the business and community affairs of Worcester and Central Massachusetts for nearly 150 years, the Worcester Regional Chamber of Commerce recognizes our obligation to speak out and acknowledge the discrimination that has so adversely impacted black Americans for generations.

We strongly support the right of those who protest peacefully and applaud the many who have done so in seeking to bring about needed change. We condemn those smaller groups and individuals who have chosen a path of violence and vandalism.

Discrimination and racism, dates back to the origins of this country. While progress has been made since then, the recent murders of George Floyd and Ahmaud Arbery reinforce that a greater urgency and obligation is required from all people in our society. There is an urgency to seek, not only equal justice under the law for all Americans, but equal economic and educational opportunities as well. We all have an obligation to be especially cognizant of this for those who have been subjected to systemic racism over generations, namely black Americans.

As the Worcester Regional Chamber of Commerce prepares for its 150th anniversary in 2025, we vow to redouble our efforts to help build a community in Worcester and Central Massachusetts that provides equal justice and opportunity for all segments of society.

UPCOMING CHAMBER EVENTS

Supporting Behavioral Health Needs in the Community and Workplace during COVID19

ONLINE | What your Business Needs to Know about Phishing and Other Social Engineering Attacks & How to Prevent Becoming a Victim

Tuesday, June 16, 8:30 am

REGISTER | Sponsored by TD Bank

#43 | Friday, May 29, 2020 | Reopening Guidelines, Control Template, Posters, PPP Forgiveness Application

Massachusetts Reopening Guidelines

Mandatory Workplace Safety Standards

Mass. DPH and COVID-19 Command Center issued mandatory workplace safety standards that apply universally to all workplaces open in Phase 1, and are applicable to all sectors and industries. These safety standards also have additional sector-specific safety protocols and recommended best practices.

COVID-19 Control Plan Template

All Massachusetts businesses must develop a written control plan outlining how its workplace will comply with the mandatory safety standards for operation in the COVID-19 reopening period. This template may be filled out to meet that requirement. Control plans do not need to be submitted for approval but must be kept on premise and made available in the case of an inspection or outbreak. All individually listed businesses must complete a control plan, even if the business is part of a larger corporation or entity. VIEW | DOWNLOAD THE TEMPLATE

Required Workplace Posters

Customer facing businesses are required to print, sign, and post signage that is visible to workers and visitors. These posters describe the rules for maintaining social distancing, hygiene protocols, and cleaning and disinfecting.

DOWNLOAD | Compliance Attestation Poster DOWNLOAD | Employer Poster DOWNLOAD | Worker Poster

All of these documents can also be found in different languages here.

Deadline Today…Empowerment Grant for Small Businesses

The State Treasurer’s Economic Empowerment Grant applications are due today. Funding decisions will be made by June 12.

VIEW & COMPLETE THE LOAN FORGIVENESS APPLICATION

UPCOMING CHAMBER EVENTS

Supporting Behavioral Health Needs in the Community and Workplace during COVID19

Wednesday, June 3, 10 am

REGISTER | Sponsored by Fallon Health

Recalls, Refusals, and the Future of Unemployment

Wednesday, June 3, 2 pm

Financial risk of COVID-19 Unemployment charges, Tracking & protesting charges, Best practices for implementing your recall process to limit UI liability, “Good cause” for refusing to return

REGISTER | Sponsored by Fallon Health

ONLINE | What your Business Needs to Know about Phishing and Other Social Engineering Attacks & How to Prevent Becoming a Victim

Tuesday, June 16, 8:30 am

REGISTER | Sponsored by TD Bank

#42 | Wednesday, May 27, 2020 | PPP Forgiveness Application, Members Doing Good, Empowerment Grants, Events

Deadline is Friday for Empowerment Grant for Small Businesses

The State Treasurer’s Office of Economic Empowerment is funding the Empowerment Grant for Small Businesses to support the needs of Massachusetts small businesses during the COVID-19 pandemic. The grant application period will close on May 29. Funding decisions will be made by June 12. Submit an application.

Chamber Members Doing Good

Clinton Savings Bank

Thanks to Clinton Savings Bank who donated $20,000 to five local food pantries, providing healthy food to residents and those on the frontline of COVID-19. The donations were organized by the bank’s donation and charitable contributions committee.

Contributions to the Worcester Together Fund

These Chamber members made donations of $10,000 to the fund: Harvard Pilgrim Health Care Foundation, Imperial Distributors, Industrial Packaging, Mercantile Center

PPP Loan Forgiveness

The small business administration released the paycheck protection program loan forgiveness application. The SBA will not except these loan forgiveness applications unless it is received by an approved lender.

VIEW & COMPLETE THE LOAN FORGIVENESS APPLICATION

STAY TUNED for the Chamber’s upcoming webinars on how to ensure that you are correctly filing for loan forgiveness. INFO TO COME SOON.

UPCOMING CHAMBER EVENTS

Managing Your Business’ Cash Flow During a Crisis – Excel Tools and Strategies

Thursday, May 28, 10 am

Better understand how to manage your business’ cash flow during a crisis. Get the most out of the economic and Excel tools that are available to you today.

REGISTER | Sponsored by Fallon Health

Supporting Behavioral Health Needs in the Community and Workplace during COVID19

Wednesday, June 3, 10 am

REGISTER | Sponsored by Fallon Health

Recalls, Refusals, and the Future of Unemployment

Wednesday, June 3, 2 pm

Financial risk of COVID-19 Unemployment charges, Tracking & protesting charges, Best practices for implementing your recall process to limit UI liability, “Good cause” for refusing to return

REGISTER | Sponsored by Fallon Health

ONLINE | What your Business Needs to Know about Phishing and Other Social Engineering Attacks & How to Prevent Becoming a Victim

Tuesday, June 16, 8:30 am

REGISTER | Sponsored by TD Bank

#41 | Friday, May 22, 2020 | PPP Forgiveness Application, MassHire, Events

Career Recovery Resources

MassHire is offering career recovery resources through virtual services that includes a virtual job fair, job listings, free training, and many other resources for job seekers.

VIEW THEIR LATEST COMMUNICATION

PPP Loan Forgiveness

This week the small business administration released the paycheck protection program loan forgiveness application.

If you qualified for the paycheck protection program loan — and qualify for the forgiveness — you must apply through this application and submit it through your lender.

The SBA will not except these loan forgiveness applications unless it is received by an approved lender.

VIEW & COMPLETE THE LOAN FORGIVENESS APPLICATION

STAY TUNED for the Chamber’s upcoming webinars on how to ensure that you are correctly filing for loan forgiveness. INFO TO COME SOON.

UPCOMING CHAMBER EVENTS

Operations: Practical and Legal Challenges of Reopening

Wednesday, May 27, 10 am

A review of the practical steps required for a safe work space including PPE materials, hand sanitizer, cleaning solutions, and other office supplies. Documenting the return to work, employee policy, guests/customers policy, posters, CDC announcements, temperature checks, employee questionnaires, staggered shifts, leave issues and a refusal of employees to return to work will be discussed.

REGISTER | Sponsored by Fallon Health

Managing Your Business’ Cash Flow During a Crisis – Excel Tools and Strategies

Thursday, May 28, 10 am

Better understand how to manage your business’ cash flow during a crisis. Get the most out of the economic and Excel tools that are available to you today.

REGISTER | Sponsored by Fallon Health

Supporting Behavioral Health Needs in the Community and Workplace during COVID19

Wednesday, June 3, 10 am

REGISTER | Sponsored by Fallon Health

Recalls, Refusals, and the Future of Unemployment

Wednesday, June 3, 2 pm

Financial risk of COVID-19 Unemployment charges, Tracking & protesting charges, Best practices for implementing your recall process to limit UI liability, “Good cause” for refusing to return

REGISTER | Sponsored by Fallon Health

ONLINE | What your Business Needs to Know about Phishing and Other Social Engineering Attacks & How to Prevent Becoming a Victim

Tuesday, June 16, 8:30 am

REGISTER | Sponsored by TD Bank

#40 | Wednesday, May 20, 2020 | PPP Forgiveness Application, LISC Grants Deadline Today, FB Live Chamber 360 Pivot, Events

PPP Loan Forgiveness

This week the small business administration released the paycheck protection program loan forgiveness application.

If you qualified for the paycheck protection program loan — and qualify for the forgiveness — you must apply through this application and submit it through your lender.

The SBA will not except these loan forgiveness applications unless it is received by an approved lender.

VIEW & COMPLETE THE LOAN FORGIVENESS APPLICATION

LISC Small Business Relief Grants

DEADLINE TODAY | Wednesday, May 20 at 11:59 pm

Small businesses and enterprises affected by COVID-19 — especially those in underserved communities, including entrepreneurs of color, women- and veteran-owned businesses that often lack access to flexible, affordable capital — are eligible to apply for this grant.

Facebook Live

Watch the Chamber’s first Facebook Live event – today’s ribbon cutting for the new Bean Counter Bakery on Grove St. in Worcester.

It’s pinned to the top of our Facebook page!

UPCOMING CHAMBER EVENTS

Operations: Practical and Legal Challenges of Reopening

Wednesday, May 27, 10 am

A review of the practical steps required for a safe work space including PPE materials, hand sanitizer, cleaning solutions, and other office supplies. Documenting the return to work, employee policy, guests/customers policy, posters, CDC announcements, temperature checks, employee questionnaires, staggered shifts, leave issues and a refusal of employees to return to work will be discussed.

REGISTER | Sponsored by Fallon Health

Managing Your Business’ Cash Flow During a Crisis – Excel Tools and Strategies

Thursday, May 28, 10 am

Better understand how to manage your business’ cash flow during a crisis. Get the most out of the economic and Excel tools that are available to you today.

REGISTER | Sponsored by Fallon Health

Supporting Behavioral Health Needs in the Community and Workplace during COVID19

Wednesday, June 3, 10 am

REGISTER | Sponsored by Fallon Health

Recalls, Refusals, and the Future of Unemployment

Wednesday, June 3, 2 pm

Financial risk of COVID-19 Unemployment charges, Tracking & protesting charges, Best practices for implementing your recall process to limit UI liability, “Good cause” for refusing to return

REGISTER | Sponsored by Fallon Health

ONLINE | What your Business Needs to Know about Phishing and Other Social Engineering Attacks & How to Prevent Becoming a Victim

Tuesday, June 16, 8:30 am

REGISTER | Sponsored by TD Bank

#39 | Monday, May 18, 2020 | Mass. Reopening Plan, LISC Grants, Events

Baker Announces “Phased Re-opening Plan”

Manufacturing, construction companies, and houses of worship can resume operations with restrictions, capacity limitations, and staggered start times today, May 18. Businesses that were deemed essential will have until May 25 to comply with safety standards aimed at limiting the spread of the virus.

MAY 25, 2020

• Offices*, labs, personal services like hair salons by appointment), pet grooming, and car washes can also open with some restrictions.

• Activities and outdoor locations like beaches, parks, drive-in theaters, some athletic fields and courts, most fishing, hunting, and boating will be accessible on May 25, Memorial Day.

• Other health care providers who attest to specific public health/safety standards can provide high priority preventative care, pediatric care and treatment for high risk patients

• Retail remote fulfilment and curbside pickup

• *Office spaces in Boston can open on June 1 with a 25 percent limit on the number of people who can show up to work.

Restaurants and lodging will receive the go-ahead to open with restrictions and some capacity limitations once phase two of the reopening plan launches. Additional personal services like nail salons and day spas are also included in phase two.

When Phase III arrives, residents can expect bars, casinos, and all other business activities to resume with restrictions and capacity limitations. Large venues and nightclubs will remain closed during phase three.

During Phase IV, the state plans to enter into a “new normal” with full resumption of activities and business operations.

VIEW THE PHASED REOPENING PLAN | Reopening Massachusetts | Mandatory standards for workplace

LISC Small Business Relief Grants

Application period for round 3 is now open. Before applying, please review the grant information and FAQ here.

Applications must be submitted by Wednesday, May 20 at 11:59 pm.

Who is eligible?

Small businesses and enterprises affected by COVID-19 across the country, especially those in underserved communities, including entrepreneurs of color, women- and veteran-owned businesses that often lack access to flexible, affordable capital.

Applications will be reviewed based on criteria designed to prioritize particularly challenged businesses, and the final grantees will be randomly selected from the top scoring applicants.

MORE INFO, APPLY

Good News!

Member business, the Bean Counter Bakery & Cafe will celebrate their grand opening on Wed., May 20 at their new location on 270 Grove Street.

Upcoming Webinars

sponsored by

Tuesday, May 19, 10 am REGISTER Tuesday, May 26, 10 am REGISTRATION OPEN SOON Wednesday, May 27, 10 am REGISTRATION OPEN SOON Wednesday, June 3, 10 am REGISTRATION OPEN SOON Wednesday, June 3, 2 pm REGISTRATION OPEN SOON![]()

#38 | Wednesday, May 13, 2020 | HEROES Act, Members Doing Good

“HEROES” Act Proposed as the Second-round of the Stimulus Relief Package

Yesterday, the U.S. House of Representatives unveiled the latest COVID-19 relief program: The Health and Economic Recovery Omnibus Emergency Solutions Act or the “HEROES” Act. It is anticipated that the vote will occur as early as this Friday, May 15.

This new $3 trillion bill includes assistance to state and local governments, hazard pay for frontline health care workers, forgiveness of student debt and bolstering Medicaid and Medicare.

The bill also includes provisions to assist farmers, protect renters and homeowners from evictions and foreclosures, and extend family and medical leave provisions previously approved by Congress. The legislation would also provide relief for essential workers, such as aviation, rail and Amtrak workers, as well as extend work visas for immigrants.

For unemployed workers, it would continue the $600-per-week boost through January. The federal benefit currently extends through the end of July. The Chamber will continue to monitor this bill and provide updates as this bill makes its way through the House and Senate.

Chamber Members Continue to Do Good

WPI

At WPI, a team from Innovation and Entrepreneurship has been using a prototyping lab to create more than 550 NIH-approved shields to be donated. The multidisciplinary team innovating in the face of a global challenge plans to continue making shields as long as needed. READ MORE

Wells Fargo

Worcester State University

Unum

Thank you to these three Chamber members who each donated $5,000 to the Worcester Together Fund along with various other ways in which they are supporting the community.

Upcoming Webinars

sponsored by

Tuesday, May 19, 10 am REGISTER Wednesday, May 20, 10 am REGISTRATION OPEN SOON Tuesday, May 26, 10 am REGISTRATION OPEN SOON Wednesday, May 27, 10 am REGISTRATION OPEN SOON![]()

#37 | Monday, May 11, 2020 | Agricultural Loans, WPS Statement, Members Doing Good, Grants, PPP, Webinars

SBA Slashes Disaster-loan Limit from $2 Million to $150,000

D ue to limitations in funding availability, and the unprecedented submission of applications already received, new eligibility requirements for Economic Injury Disaster Loan and Advance are now in place. Only agricultural business applications will be accepted.

Please note that applicants must apply through the SBA directly not through a lender.

Chamber Supports Accountability for Teachers and Students in Worcester Public School System During Remote Learning Environment

On behalf of our members, and the broader business community, the Worcester Regional Chamber of Commerce has long been involved in educational issues at all levels of government. Because of its importance to economic development and employer workforce needs, the Chamber recently came out in support of Worcester Public School Superintendent Binienda’s efforts to facilitate student engagement in a remote learning environment.

See the full statement made by the Chamber’s Director of Government Affairs and Public Policy, Alex Guardiola.

Chamber Members Continue to Do Good

Thanks to these members who donated $10,000 each to the Worcester Together Fund supporting those affected by COVID-19.

Assumption College

Bay State Savings Bank

Bowditch & Dewey Fund

Kudos to these individuals (who are part of member companies) and who donated $5,000 each to the Worcester Together Fund supporting those affected by COVID-19.

J. Christopher & Catherine Collins

Howard and Carolyn Stempler

Kevin Condron

The Empowerment Grant for Small Businesses

Grants are still available through the State Treasurer’s Office of Economic Empowerment MORE INFO | APPLICATION

PPP Applications Still Available

Contact your current lender or to find a lender CLICK HERE.

Applications Have Closed for Worcester’s Small Business Resiliency Program

The COVID-19 Small Business Resiliency Grant program to award up to $5,000 to business affected by the coronavirus has ended its acceptance of applications.

Upcoming Webinars

sponsored by

Tuesday, May 12, 2 pm REGISTER Wednesday, May 13, 10 am REGISTER Tuesday, May 19, 10 am REGISTER Wednesday, May 20, 10 am REGISTRATION OPEN SOON Tuesday, May 26, 10 am REGISTRATION OPEN SOON Wednesday, May 27, 10 am REGISTRATION OPEN SOON![]()

#36 | Friday, May 8, 2020 | Leadership Worcester, PPP, Grants Mask Requirements

Eversource Offers Businesses a Payment Plan to Ease Financial Obligations

Eversource is offering special, extended payment arrangement for business customers. On any past-due amount, with $0 down payment, businesses will have 12 months to pay. They will also connect businesses with state and federal assistance programs for which your business may be eligible. MORE INFO | ENROLL

Worcester Public Schools

Night Life Continuing Education | Career Technical Training and Lifelong Learning

Free online courses for workforce success are offered through the Worcester Public School continuing education program. Having the right skills and knowing how to utilize them is vital for job seekers and those currently employed, both during and after the COVID-19 pandemic. Leverage these courses to help enter the workforce or advance your career.

LEARN MORE ABOUT THESE FREE ONLINE COURSES Creating Web Pages Fundamental of Management and Supervision

WEB DESIGN COURSES

Creating WordPress Web SitesBUSINESS AND ORGANIZATIONAL MANAGEMENT COURSES

Keys to Effective Communication

Managing Customer Service

PERSONAL AND PROFESSIONAL DEVELOPMENT COURSES

Individual Excellence

Personal Finance

Twelve Steps to a Successful Job Search

DIGITAL MARKETING COURSES

Marketing Your Business of the Internet

Small Business Marketing on a Shoestring

Happy Mother’s Day to all of the moms out there.

If you plan on sending flowers this year, please patronize one of our member florists listed below.

FLOWER SHOPS

Holmes-Shusas Florist | 508-853-2550

Flowers from the Heart | 508-917-8421

The Harmonious Soul | 508-269-4972

Posies ‘N Presents | 508-581-4164

Douglas Flower Shoppe | 508-476-5959

Dove Tales Floral Studio | 508-928-0170

Chamber Members Continue to Do Good

Bartholomew & Company | Fallon Health

Fletcher Tilton | Tufts Health Plan Foundation

Thank you to these generous Chamber members who each donated $50,000+ to the Worcester Together Fund.

The Empowerment Grant for Small Businesses

Grants are still available through the State Treasurer’s Office of Economic Empowerment MORE INFO | APPLICATION

PPP Applications Still Available

Contact your current lender or to find a lender CLICK HERE.

Upcoming Webinars

sponsored by

Returning to Work During COVID-19: Occupational Health Guidelines and Best Practices for Cleaning & Disinfection

Tuesday, May 12, 2 pm REGISTER

Contract Essentials During COVID-19: Managing Existing and Future Contracts

Wednesday, May 13, 10 am REGISTER

Tuesday, May 19, 10 am REGISTER

Tax Impacts of the COVID-19 Stimulus Bill

Mental Health and COVID-19: How it Affects Your Family, Staff, and You

Wednesday, May 20, 10 am REGISTRATION OPEN SOON

Managing Your Business’ Cash Flow During a Crisis

Tuesday, May 26, 10 am REGISTRATION OPEN SOON

Resuming Operations: Legal Considerations and Best Practices

Wednesday, May 27, 10 am REGISTRATION OPEN SOON

#35 | Thursday, May 7, 2020 | Fallon Health Steps up to Sponsor Webinars for Businesses

Longtime Chamber Supporter, Fallon Health Makes Continued COVID-19 Webinars Possible Through Additional Funding

The Chamber is pleased to announce that Fallon Health is now sponsoring our COVID-19-related webinars. Many of these virtual offerings are designed specifically to help businesses navigate the multiple issues they are facing because of the COVID-19 crisis. The information that we provide through this new programming is critical support for these businesses, many of whom are small and have increasingly limited resources.

On behalf of the entire business community, we thank Fallon Health for their support of the Chamber during this crisis and for helping to take care of our community during this pandemic.

Upcoming Webinars

sponsored by

Returning to Work During COVID-19: Occupational Health Guidelines and Best Practices for Cleaning & Disinfection

Tuesday, May 12, 2 pm REGISTER

Contract Essentials During COVID-19: Managing Existing and Future Contracts

Wednesday, May 13, 10 am REGISTER

Tuesday, May 19, 10 am REGISTER

Tax Impacts of the COVID-19 Stimulus Bill

Mental Health and COVID-19: How it Affects Your Family, Staff, and You

Wednesday, May 20, 10 am REGISTRATION OPEN SOON

Managing Your Business’ Cash Flow During a Crisis

Tuesday, May 26, 10 am REGISTRATION OPEN SOON

Resuming Operations: Legal Considerations and Best Practices

Wednesday, May 27, 10 am REGISTRATION OPEN SOON

#34 | Wednesday, May 6, 2020 | 2 New Grants Available

#34 | Wednesday, May 6, 2020

Beginning Today, Face Coverings are Now Required When in Public

Governor Baker has issued an order effective today Wednesday, May 6 requiring face masks or cloth face coverings in public places where social distancing is not possible. This applies to both indoor and outdoor spaces. Exceptions include children under the age of 2 and those unable to wear a mask or face covering due to a medical condition. Read the order and get tips here: Department of Public Health Guidance. Make your own: Instructions to make your own face covering.

Massachusetts Clarifies Rules for Nonessential Businesses, Allows Some Remote Sales Staff

The Baker-Polito administration updated its guidance on Monday to allow certain nonessential retail businesses, from flower shops to car dealerships, to bring back employees for remote sales only .

In addition, the new guidance opens the door for book shops, jewelers, sporting goods stores, video game stores, and other shuttered retailers to bring back between three and seven employees depending on the size of their facility, as long as they adhere to certain social distancing and sanitation rules.

While the essential services list has not changed since March 31, the administration has updated its Frequently Asked Questions page to make additional clarifications. VIEW FAQs

Last Day for Small Business Resiliency Program

The City of Worcester has established the COVID-19 Small Business Resiliency Grant to assist in the stabilization of existing small businesses within the City of Worcester that have had significant business disruption due to the impact of COVID-19. These grant funds will assist small business in the City of Worcester to cover wages, rent, loss of inventory, and other fixed costs. Grants are capped at $5,000 per business. Please use this application and send to development@worcesterm.gov.

Empowerment Grant for Small Busnesses

The State Treasurer’s Office of Economic Empowerment is funding the Empowerment Grant for Small Businesses to support the needs of Massachusetts small businesses during the COVID-19 pandemic. The grant application priod opened Monday and will close on May 29. Fundig decisions will be made by June 12. Submit an application.

Chamber Members Continue to Do Good

Fairlawn Foundation Fund

Fallon/OrNda Community Health Fund

Fletcher Foundation

Thanks to these three charitable organizations who had a

large and positive impact on the community with each donating

$100,000 to the Worcester Together Fund.

Chamber Members Continue to Do Good

Bank of America

Locally, Chamber member Bank of America has donated $100,000 to the Worcester Together Fund. Thank you!

This avid community supporter has stepped up again to donate $100,000 to the Worcester Together Fund.

George F. & Sybil H. Fuller Foundation

Thank you to this long-time Chamber supporter who donated $50,000 to the Worcester Together Fund.

Sincere appreciation to BC/BC of Mass for their donation of $50,000 to the Worcester Together Fund.

#33 | Tuesday, May 5, 2020 | 2 New Grants Available, Behavioral Health Webinars, Leadership Worcester, Members Doing Good

The Empowerment Grant for Small Businesses

To support the needs of Massachusetts small businesses during the COVID-19 pandemic.

The State Treasurer’s Office of Economic Empowerment is funding the Empowerment Grant for Small Businesses to support the needs of Massachusetts small businesses during the COVID-19 pandemic. The grant application period opened Monday and will close on May 29. Funding decisions will be made by June 12.

The grant will be awarded to small businesses in Gateway Cities across the state. The goal of the program is to stabilize and support the well-being of small businesses by providing access to capital and building financial empowerment through one or more trainings. Grants of up to $2,500 are available and will empower small business owners to support business continuity and foster ingenuity .

Applicants are eligible if they are:

• considered a small business,

• have been in operation for at least one year,

• and are registered in Massachusetts.

Preference will be given to those that operate in a Gateway City. Minority-owned, women-owned, veteran-owned, and/or immigrant-owned small businesses are encouraged to apply. MORE INFO | APPLICATION

SBA Announces Grants, Loans Available to Farms, Agricultural Businesses

Farms and other agricultural employers can start applying for grants and low-interest, long-term loans through the Small Business Administration’s Economic Injury Disaster Loan program.

Agribusinesses are eligible for grants of up to $10,000 under the EIDL Advance program and loans up to $2 million under the EIDL program.

Eligible agricultural businesses include businesses in the:

• legal production of food and fiber,

• ranching, raising of livestock,

• aquaculture and other agriculture-related industries,

• and have 500 or fewer employees.

The SBA started accepting new EIDL applications May 4 on a limited basis only. For agribusinesses that have already submitted an EIDL loan application through the portal prior to the legislative change, SBA will process those applications without requiring applicants to re-apply. All other applications will be processed on a first-come, first-serve basis.

Apply for EIDL loans on the SBA website (not through your lender).

Free Behavioral Health Resources for Chamber Members

Check out this important Workforce Webinar Series and receive additional access to mental health resources to support your employees during COVID-19. Sessions take place every Thursday in May (7, 14, 21, 28) at 1:30 and focus on anxiety and depression, uncertainty, psychological safety, and how to help your team. MORE INFO OR TO REGISTER

Leadership Worcester

Now more than ever we recognize that strong local leadership matters as it relates to the health and economic well being of our community.

We must continue to build the next generation of Central Massachusetts leaders. Please consider nominating an employee for this important program, or if you are interest yourself, please consider applying. It will help you, and your organization, to develop the leaders we need.

Learn more about the program and apply by the May 29 deadline.

Chamber Members Continue to Do Good

Bank of America

Locally, Chamber member Bank of America has donated $100,000 to the Worcester Together Fund. Thank you!

This avid community supporter has stepped up again to donate $100,000 to the Worcester Together Fund.

Thank you to this long-time Chamber supporter who donated $50,000 to the Worcester Together Fund.

Sincere appreciation to BC/BC of Mass for their donation of $50,000 to the Worcester Together Fund.

#32 | Monday, May 4, 2020 | Grants for Worcester Businesses, Advisory Board Input, Members Doing Good

Funding Still Available through Chamber Microloan Program Partnership

Worcester Regional and North Central Chamber Emergency Loans

REMINDER | Applications are due by Wednesday, May 6 at 11:59 pm for the Second Round of Small Business Resiliency Grants for Worcester Businesses

If you are a small, Worcester-base business, grants for $5,000 will continue to be accepted until 11:59 pm Wednesday.

For more info, or to apply, visit the city’s website.

Do You Have Advisory Board Input?

Send us your suggestions.

Business owners understand their industries better than anyone.

As the Advisory Board continues to discuss reopening businesses, we want to be sure that you have input into the policies and procedures that come out of this group. The Chamber is facilitating input from members to the board.

Submit your ideas about safe, responsible reopening plans to David Sullivan, the Chamber’s Economic Development Fellow.

Chamber Members Continue to Do Good

Lake Pharma

Vaccines, tests, and treatments for COVID-19 are all being developed in Worcester by Chamber member, Lake Pharma. The robust amount of work being conducted right here in Worcester should be a point of pride and gratitude for the city. Out hats are off to the dedicated scientists who are battling this disease on all three fronts in just one, very important and highly motivated company. READ MORE

Worker’s Credit Union

Thanks to member, Workers Credit Union, who donated more than $31,000 to area organizations during the COVID-19 pandemic. Much of their donation is supporting the recovery fund, Making Opportunity Count, part of the North Central Mass Development Corp. with additional donations to organizations providing food support among other coronavirus responses. READ MORE

#31 | Friday, May 1, 2020 | Grants for Worcester Businesses,

Funding Still Available through Chamber Microloan Program Partnership

Worcester Regional and North Central Chamber Emergency Loans

Emergency loans of up to $20,000 for small businesses negatively impacted by the coronavirus are offered through the North Central Massachusetts Development Corp.

Applicants must be a Central Massachusetts business and must complete the loan application package and provide a complete copy of the last two years of both personal and business tax returns (federal only). If the 2019 tax returns have not yet been filed, a 2019 profit and loss statement must be included.

Loans have a 5% interest rate over a 48-month term with payments deferred for six months. There are no early repayment penalties. Due to high demand, please apply as early as possible.

The NCMDC continues to offer its regular loans of up to $150,000, although those take longer to approve, and include additional assistance from chaber staff and consultants. LOAN INFO

For more information please contact: info@worcesterchamber.org

Please note, that this is not a Paycheck Protection Program (PPP) loan and this emergency loan is not related to the SBA EIDL Program

REMINDER | APPLICATIONS ACCEPTED BEGINNING TODAY FOR

Second Round of Small Business Resiliency Grants for Worcester Businesses

The second round of the City’s COVID-19 Small Business Resiliency Grant Program launched today. For more info, or to apply, visit the city’s website.

Applications are due by Wednesday, May 6 at 11:59 pm. Grants for this second round are capped at $5,000 per business due to limited funding. The City expects to award up to 160 businesses a total of $800,000.

Voice of Business Broadcast

The Chamber’s radio show, the Voice of Business, is an hour-long weekly broadcast on WCRN 830 AM airing on Wednesdays from 9 – 10 am.

The show, sponsored by Worcester Regional Airport and Fidelity Bank, is hosted by the various Chamber staffers is also available as a podcast on SoundCloud.

During the pandemic, the show often features guests who have a role in combating COVID-19. The interview format features guests from a variety of industries and backgrounds on topics of interest to the business community. The show keeps listeners up-to-date on the latest trends in business, local projects, legislation, higher education, events and other relevant discussions affecting the region’s business climate. To inquire about being a guest on the show, contact Virgina Parent.

Chamber Members Continue to Do Good

The Guru Tax & Financial Services

Kudos to Chamber member, and board treasurer, Satya Mitra from The Guru Tax & Financial Series, who with his wife Sheema, donated $30,000 to the City of Worcester’s homeless shelter project, $1,000 each to the WSU student emergency fund, Girls, Inc., and $1,560 to Open Sky Community Services, through their Joy Guru Humanitarian Services charitable organization. READ MORE

AbbVie

AbbVie, a biotech company and Chamber member, with a research facility in Worcester, donated $15,000 locally to the Worcester Together Fund. Nationally, the company is supporting clinical research on COVID-19

#30 | Thursday, April 30, 2020 | Grants for Worcester Businesses Available Fri., May 1

IMPORTANT INFORMATION FOR WORCESTER BUSINESSES

Worcester to Open Second Round of Small Business Resiliency Grants Tomorrow | Fri., May 1 at 8:30 AM

The second round of the City’s COVID-19 Small Business Resiliency Grant Program will launch tomorrow, Friday, May 1 at 8:30 am. The application form and instructions will be available tomorrow on the City’s website.

Applications are due by Wednesday, May 6 at 11:59 pm.

Grants for this second round are capped at $5,000 per business due to limited funding. The City expects to award up to 160 businesses a total of $800,000.

ELIGIBILITY CRITERIA are similar to the first round with a couple of additions:

• Have a physical establishment occupying commercial space within the City of Worcester.

• The business owner must be low- to moderate-income as defined by HUD.

• Have experienced a loss of revenue of 50% or more due to COVID-19.

• Businesses that have less than $2,000,000 in average gross annual revenues.

• Businesses that have not been approved for funding through other grant or forgive-able loan programs related to COVID-19 relief.

• The business must be in good standing with no outstanding tax liens or legal judgements.

Applicants needing translation assistance have a number of options. The Economic Development office has staff that are fluent in Spanish, Vietnamese, Albanian and Portuguese. Additional translation assistance will be made available upon request.

SEMINAR IN SPANISH

The City is also working with the Latin American Business Organization (LABO) and the Worcester Regional Chamber of Commerce to provide an instructional webinar in Spanish on Monday, May 4 at 11 am.

Information about the webinar will be posted with the application information on the City’s website.

For questions and information, please contact the City’s Economic Development office via email at development@worcesterma.gov

DURING THIS CRISIS, WEBINARS ARE OPEN TO ALL AT NO COST

#29 | Wednesday, April 29, 2020 | Stay at Home Extended, Advisory Board Input, Notarization, PPP Forgiveness, Good Deeds

#29 | Wednesday, April 29, 2020

Stay at Home Order Extended to May 18, Advisory Board Announced, Opportunity for Input

Yesterday, April 28, Governor Baker and his administration announced the extension of the Non-Essential business closures from May 4 to May 18.He also announced the creation of the “Reopening Advisory Board” chaired by Lt. Governor Karyn Polito.

Businesses and organizations that are not on the list of essential services are encouraged to continue operations through remote means. The order also extends the existing ban on gatherings of more than 10 people until May 18.

We want to hear from you. Send us your suggestions.

As the Advisory Board begins to discuss reopening businesses, it is imperative that we obtain feedback from our members as well as our broader business community on the kinds of precautionary plans that are being implemented in your industries so that we can forward to the advisory board.

With the importance of proper social distancing, preemptive protocols and responsible practices must be implemented to ensure the safe opening of all our businesses.

The Worcester Regional Chamber of Commerce is asking that you please submit your ideas about safe, responsible reopening plans to David Sullivan, the Chamber’s Economic Development Fellow.

READ MORE about the extension announcement.

Massachusetts Allows Virtual Notarization

New Law Allows Continuation of Business Requiring Notarization

On April 27, 2020, Massachusetts Governor Charlie Baker signed into law an emergency measure to authorize Massachusetts notaries public to use real-time electronic video conferencing to perform “an acknowledgement, affirmation or other notarial act” during the COVID-19 crisis.

The principal signing the document, witnesses, and notary public need not be in each other’s physical presence; however, in addition to the audio and video recording (retained for 10 years):

• The notary public must observe each principal’s execution of a document

• The notary public and each principal must be physically located in Massachusetts

• The principal must deliver the executed document to the notary public

With respect to any document “involving a mortgage or other conveyance of title to real estate,” the notary public and each principal are both required to engage in a second video conference during which each principal verifies that the document received by the notary public is the same document executed during the initial video conference.

The principal must make disclosure of any person present in the room and make that person viewable to the notary public.

The notary public must provide an affidavit that must be retained for 10 years.

PPP FORGIVENESS: The Clarity & Confidence Businesses Need Right Now

Prepared by Fidelity Bank

Local business is the lifeblood of our communities. And, as part of their LifeDesign banking approach, Fidelity Bank focuses on the health and well-being of our area businesses, their employees, and our communities.

To aid their clients, and all small businesses, in planning for the proceeds of the Paycheck Protection Program relief loans, their CARES Act Support Team has developed a set ofPPP Loan Forgiveness FAQs . Their intent is to help bring clarity so that businesses can make informed decisions with confidence during this difficult time. Review thePPP Loan Forgiveness FAQs

Chamber Members Continue to Do Good

FLEXcon

Kudos to Chamber member FLEXcon who donated $50,000 to the Worcester Together Fund supporting those most affected. The company is also making face shields that are available for purchase.READ MORE

Novo Nordisk

Ongoing health issues still require treatment and thanks to member Novo Nordisk, diabetes patients are eligible for free insulin for 90 days if they have lost health insurance due to job loss from the pandemic. READ MORE

UPCOMING CHAMBER EVENTS

Gratis Seminario: Web de Recursos para Pequeñas Empresas

Wednesday, April 29, 3 – 5 pm | REGISTER

Virtual Business After Hours with Dr. Eric Dickson, UMassMemorial and Carolyn Jackson, Saint Vincent

Thursday, April 30, 5 pm | REGISTER

Strategy for COVID-19 Financial Relief: Restructuring Your Business Loans

Thursday, May 7, 10 am | REGISTER

Tax Impacts of the COVID-19 Stimulus Bill

Tuesday, May 19, 10 am | REGISTER

Resuming Operations: Legal Considerations and Best Practices

Wednesday, May 27, 10 am | REGISTER

DURING THIS CRISIS, WEBINARS ARE OPEN TO ALL AT NO COST

#28 | Monday, April 27, 2020 | PPP Loan applications open today, Tech for Schools, Good Deeds

IMPORTANT NOTICE

PPP Applications Resumes Today at 10:30 am

The SBA will resume accepting Paycheck Protection Program applications from participating lenders on Monday, April 27, 2020 at 10:30 am.

Please contact your current lender or to find a lender CLICK HERE.

Got Technology You’re Not Using?

Schools need: Chromebooks, newer iPads, laptops

With remote learning becoming the new norm, Worcester Public Schools are in need of Chromebooks and newer iPads for students and laptops for staff.

Please make an appointment to drop off your donation. Email Sarah Kyriazis or call/text 508-769-7820.

Today is Takeout Day in Worcester

In a show of support, and to help Worcester restaurants, the Worcester City Council voted to make today “takeout day” in Worcester. The goal is to encourage more people to order takeout from restaurants, boost their sales, and help them to stay afloat until the stay at home order is lifted. So, why not try something new today and, before you dive in, be sure to take a photo and share it with the Chamber on social media using the hashtag #TakeOutDay. Here’s a list of OPEN RESTAURANTS.

Chamber Members Continue to Do Good

Advantage Truck Group and Worcester Railers

Chamber members Advantage Truck and the Worcester Railers are partnering on Food for Frontliners. They will donate food and gift cards purchased from local restaurants to area food pantries, healthcare facilities, and fire and police departments. Donations totaling more than $10,000 will be made each Monday through the end of May. Today’s lunch donation will go to healthcare workers and cleaning staff at UMass Memorial in Worcester.

READ MORE

UPCOMING CHAMBER EVENTS

LIVE – Rapid Recovery – 5 Things You Need to Know this Week

Tuesday, April 28, 10 am

FREE WEBINAR | How To Succeed with Leading During Uncertainty

Wed., April 29, 8:30 am – 9:30 am | REGISTER

Gratis Seminario: Web de Recursos para Pequeñas Empresas

Wednesday, April 29, 3 – 5 pm | REGISTER

Virtual Business After Hours with Dr. Eric Dickson, UMassMemorial and Carolyn Jackson, Saint Vincent

Thursday, April 30, 5 pm | REGISTER

DURING THIS CRISIS, WEBINARS ARE OPEN TO ALL AT NO COST

#27 | Sunday, April 26, 2020 | PPP Loan applications open Mon., April 27 at 10:30 am

IMPORTANT NOTICE

PPP Applications Resume Tomorrow, Monday, April 27, 2020

The SBA will resume accepting Paycheck Protection Program applications from participating lenders on Monday, April 27, 2020 at 10:30 am.

Please contact your current lender or to find a lender CLICK HERE.

UPCOMING CHAMBER EVENTS

LIVE – Rapid Recovery – 5 Things You Need to Know this Week

Tuesday, April 28, 10 am

FREE WEBINAR | How To Succeed with Leading During Uncertainty

Wed., April 29, 8:30 am – 9:30 am | REGISTER

Gratis Seminario: Web de Recursos para Pequeñas Empresas

Wednesday, April 29, 3 – 5 pm | REGISTER

Virtual Business After Hours with Dr. Eric Dickson, UMassMemorial and Carolyn Jackson, Saint Vincent

Thursday, April 30, 5 pm | REGISTER

DURING THIS CRISIS, WEBINARS ARE OPEN TO ALL AT NO COST

#26 | Friday, April 24, 2020 | More PPP loans coming soon, MEGA 1310 and WCCTV offer biz announcements, Free Software License, Webinars

Payroll Protection Program

U.S. House of Representatives approves $480 billion package to help small businesses and hospitals, expand Covid-19 testing

The House of Representatives voted Thursday to approve a $484 billion package to deliver aid to small businesses and hospitals and expand Covid-19 testing, the latest attempt by lawmakers to blunt the devastating impact of the pandemic.

The measure passed the Senate earlier this week and will now go to the president, where it is anticipated to be signed today. It will add an additional $310 billion for the Paycheck Protection Program. There is also $60 billion for the economic disaster injury loan fund.

The legislation also provides $75 billion for hospitals and health care providers for coronavirus expenses and lost revenue and $25 billion to facilitate and expand Covid-19 testing.

We urge small businesses who are interested in applying to contact their current lenders as soon as possible so that they can begin to gather the required documents.

Microloan Program Gets More Funding

Worcester Regional Chamber is partnering with North County Chamber to offer additional emergency $20K loans

In partnership with the Worcester Regional Chamber, the North Central Mass. Chamber announced Monday evening that it would provide emergency loans of up to $20,000 for small businesses negatively impacted by the coronavirus.

The loans, offered through its financing arm the North Central Massachusetts Development Corp., are meant to be in lieu of high-interest credit cards or expensive and unregulated online lenders. The NCMDC continues to offer its regular loans of up to $150,000, although those take longer to approve.

To qualify for the emergency loan, available to businesses throughout Central Massachusetts, a businesses must be able to provide two years of tax returns and demonstrate a direct financial impact of coronavirus on the business.

Businesses qualifying for the NCMDC loan are eligible to receive additional assistance from chamber staff and consultants.

For more information please contact: info@worcesterchamber.org

Client Requests, Staff Inspiration Result in FREE Offer to Business

Have a Message? MEGA has the Airwaves

Chamber member Gois Broadcasting, operator of Latin music station MEGA 1310, has been making special announcements related to COVID-19 for their customers. In a gesture of support for the entire business community, the station is now extending that to all Worcester businesses.

According to president Ivon Gois, “If we can give information to the community and help businesses at the same time I think we’ve accomplished something. Together we can make a real difference and we’d be happy to do our part.” Chamber members (and non members) who would like to make an announcement during this crisis can contact them with details.

Interested businesses should reach out to Kendall Westbrook at Kendall@GoisBroadcasting.com with their announcement.

FREE Announcements from Worcester’s Public Access Station Available

Public Service Announcements Aim to Help

WCCA TV, Worcester’s public access TV station, is offering free TV exposure to help Worcester businesses and other organizations who are especially challenged during the pandemic.

This public service is being offered to help businesses get the word out about whether they plan to re-open, if they are still operating, and other messages of interest to the community during the pandemic.

Episodes can run 3 to 25 minutes and will help get the word out on cable, online and on social media. Taping can take place safely live in the studio or via Skype or Zoom. Free on a limited basis and for a limited time.

For details or to schedule a time, contact Mauro DePasquale, Executive Director atmauro@wccatv.comor 508-755-1880, ext. 111.

Developers Can Access Software Licenses to Fight COVID-19

Generous Move by Member Aids Coronavirus Fight

Chamber member Alpha Software Corporationis helping software developers build and deploy apps to help during the pandemic. The company is providing complimentary licenses to its mobile and web app development platform, as well as training resources to qualifying developers and organizations.

“This is a devastating crisis, and we are looking to make a meaningful contribution in the battle against this virus,” said Richard Rabins, CEO. “With a development and deployment platform that can build web and offline-capable mobile apps in hours, Alpha Software offers the fastest method to get secure and scale-able industrial strength apps built and deployed globally, making it a valuable weapon in the war against aids COVID-19.”

Developers can contact Alpha Software to inquire about complimentary software licenses to produce COVID-19 related apps.

Chamber Members Continue to Do Good

AlphaGraphics Thanks to member AlphaGraphics who printed up signs for Main Street businesses to help us express our gratitude to all of those frontline workers who are fighting the COVID-19 battle. ABOUT THEM The WooSox donated 250 clear ponchos to be used as PPE if necessary and their WooSox Foundation pledged a donation of $10,000 to “Worcester Together” to help those impacted by the coronavirus outbreak and to aid charities in the longterm recovery of the city from this pandemic. SEE PHOTOS

Worcester Red Sox

#25 | Wednesday, April 22, 2020 | Second phase of bill Passes Senate, Waits for House, Virtual Notarization, Members Doing Good, Webinar

#25 | Wednesday, April 22, 2020

Senate Approves $480 Billion Package to Help Small Businesses and Hospitals

The Senate passed a roughly $480 billion relief package late yesterday afternoon that includes hundreds of billions of dollars in new funding for small businesses hurt by the coronavirus outbreak along with other priorities like money for hospitals and expanded Covid-19 testing.

The package was passed by a voice vote, meaning most senators would not need to return to Washington, DC, during the pandemic.

The total price tag of the bill is approximately $484 billion, which amounts to the latest unprecedented effort by Washington to prop up the economy on the heels of the $2 trillion rescue package, the $192 billion relief measure and another $8.3 billion plan Congress approved last month.

It must now be approved by the U.S. House of Representatives. If is passed the House, the bill will then move to the White House to be signed by the president.

Virtual Notarization Bill Suddenly on the Move

The process of getting documents notarized – an essential aspect of many business transactions – could be in for a major overhaul to take into account social distancing in the COVID-19 era.

A Massachusetts Senate committee was voting overnight on a bill that would enable notaries public to “perform an acknowledgement, affirmation or other notarial act” by using real-time electronic video conferencing.

The bill includes a series of stipulations that must be met to ensure a notarization is valid and effective. According to a bill summary, notaries would:

• Have to observe each principal’s execution of a document;

• The notary and each principal would take an oath swearing they are physically in Massachusetts;

• Each principal would provide the notary public with satisfactory evidence of identity; and

• A principal would have the executed document delivered to the notary public by delivery service, courier or other means.

In its current form, the terms of the special law will be repealed three business days after the governor terminates the COVID-19 state of emergency, which was declared on March 10

Chamber Members Continue to Do Good

Cornerstone Bank

Member Cornerstone Bank has made donations of $15,000 to Harrington Healthcare for PPE, $5,000 to the Railers Small Business Power Play, and $2,000 to a food pantry.

Webster Five

Our gratitude is extended to Webster Five who has generously donated $50,000 to the Worcester Together Fund providing much needed relief for our neighbors in the city.READ MORE

FREE WEBINAR | How To Succeed with Leading During Uncertainty

Wed., April 29, 8:30 am – 9:30 am | REGISTER

Our routines have changed dramatically, our work environments look nothing like they did a month ago, and our companies have had to make some of the toughest decisions in their history.

How leaders handle this crisis determines our future.In this webinar, thoughtful leadership, accountability, and the necessary steps to keep the engines running will be reviewed.

DURING THIS CRISIS, WEBINARS ARE OPEN TO ALL AT NO COST

#24 | Tuesday, April 21, 2020 | LISC Grant Program, Members Doing Good, Webinars

LISC announces the “LISC Small Business Recovery Grant Program for Massachusetts”

LISC will provide grants to hard-hit small businesses in Massachusetts to weather the immediate financial impact of closures and social distancing measures required to slow the spread of the coronavirus.

LISC will offer grants of up to $10,000 to address immediate financial peril, limit layoffs, avoid gaps in employee benefits or insurance, mitigate economic instability and increase the likelihood of business survival. Launched with seed funding provided by Citizens, the Small Business Recovery Grant Program is part of the LISC Rapid Relief & Resiliency Fund for Massachusetts.

Applications will close on Friday, April 24 at noon, 12 pm. More information.

Chamber Members Continue to Do Good

Kudos to Polar Beverages for giving away $2,500 a day to restaurant workers who use Instagram to list best item on their menus. As part of the #PolarTips campaign, a $500 tip is given to servers, chefs, hosts, dishwashers, hosts, bartenders or anyone in the restaurant industry. Speaking of beverages, Wachusett Brewing and Atlas Distributing released a new beer to raise money to support three COVID-19 response funds, operation by various United Ways, in the communities where the two companies operate.

Polar Beverages

Wachusett Brewing, Atlas Distributing

Thank you to Country Bank who bought 500 room nights at the Southbridge Hotel and Conference Center and donated $10,000 to help offset the costs for all officers, firefighters and health care workers who are staying there. READ MORE In a generous move, Chip Norton has provided rooms at a reduced cost for emergency responders at the 203-room Southbridge Hotel. It has also provided a paycheck for some hotel workers READ MORE

Country Bank

Chip Norton, Southbridge Hotel & Conference Center

UPCOMING CHAMBER EVENTS | April 22 to April 29

Sales and Leadership in the Era of Crisis

SPONSORED BY

FREE WEBINAR | How To Succeed with Selling During Uncertainty Wed., April 22, 8:30 am – 9:30 am | REGISTER Designed for business owners, sales leaders, and sales professionals, this webinar will focus on what it takes for you and your team’s sales to be successful during turbulent times. You will learn: Behavior and conversation mapping processes

Remote work environment tips for success

How to stay relevant and have meaningful and purposeful conversations

Wed., April 29, 8:30 am – 9:30 am | REGISTER

Our routines have changed dramatically, our work environments look nothing like they did a month ago, and our companies have had to make some of the toughest decisions in their history.

How leaders handle this crisis determines our future.In this webinar, thoughtful leadership, accountability, and the necessary steps to keep the engines running will be reviewed.

REGISTER – April 29

DURING THIS CRISIS, WEBINARS ARE OPEN TO ALL AT NO COST

#23 | Monday, April 20, 2020 | Patriots Day, Manufacturing Emerg. Response, CARES Act Apps Open, POW, Members Doing Good, Webinars

HAPPY PATRIOTS DAY

Today we commemorate the 245th anniversary of the Battles of Lexington and Concord. LEARN MORE

Take a virtual look at Worcester’s revolutionaries.

Virtual programs will be shared on Minute Man’s Facebook page.

TOMORROW: Attend the Power of Women Webinar

Tues., Apr 21 | 12 to 1 PM

REGISTER | LEARN MORE

Join Power of Women’s ZOOM Webinar to hear from Nikki Bell, Chief Executive Officer of Living In Freedom Together-LIFT Inc., a non-profit organization serving victims and survivors of the sex trade.

Nikki herself is a survivor of prostitution and utilized her life experience to create an organization that not only helps women to exit the sex trade but also provides employment and economic opportunities to survivors.

SPONSORED BY: JP MorganChase & Co Women on the Move, Clark University

Baker-Polito Administration Launches Manufacturing Emergency Response Team

Supporting PPE Supply Production

The Baker-Polito Administration announced $10 million in funding to support a new initiative enabling manufacturers to pivot production operations to produce personal protective equipment (PPE) and other critical devices, such as ventilators, sanitizers, and thermometers.

Manufacturing Emergency Response Team (M-ERT)

The M-ERT is a coordinated response by the administration and leading academic and industry stakeholders to support the Commonwealth’s manufacturers in their efforts to produce much-needed supplies for front-line workers and the health care system.

Companies can apply for grants through an online form for equipment, materials, supplies, workforce training and other needs. A review committee will process applications based on criteria including production timeline and recommend grant awards.

Non-Traditional Employee Unemployment Filing Begins Today under the CARES Act

Self-employed people, contract workers, and other g ig workers will have access to begin filing for unemployment benefits starting today, April 20. Under the f ederal CARES Act response to the coronavirus pandemic, t he state has expanded the unemployment insurance program to workers not previously eligible in the traditional program.

The new unemployment program provides up to 39 weeks of unemployment benefits to those who are unable to work due to COVID-19, but are not eligible for regular or extended unemployment benefits. This includes self-employed workers, independent contractors, gig economy workers, and those with a limited work history. Learn more and apply: www.mass.gov/pua.

Chamber Members Continue to Step Up to Support Community

In a generous move, Chamber member Good Chemistry has donated $50,000 to the Worcester Together COVID-19 relief fund. Stating that this pandemic is reminiscent of the AIDS crisis, founder Matthew Huron noted that when times are difficult it is important to contribute even in the face of your own adversity. The company also donated N95 masks that are part of its inventory.

#22 | Friday, April 17, 2020 | Leadership Worcester, PPP, Grants Mask Requirements

Paycheck Protection Program: Lapse in Appropriations

The U.S. Small Business Administration has announced that the Paycheck Protection Program (PPP) will not be accepting any more applications for the $349 billion program.

The agency reported that they approved more than 1.6 million PPP loans totaling more than $339 billion in partnership with over 4,900 lending institutions.

There are currently negotiations at the federal level to re-capitalize the program. If, and when this program is re-funded, the Worcester Regional Chamber of Commerce will make an immediate announcement notifying businesses about when and how to apply.

Public-facing Mask Requirements Expanded PATRONS OF AREA BUSINESSES MUST ALSO WEAR FACE COVERINGS

Worcester City Manager Edward Augustus announced yesterday the expansion of an order signed this earlier this week requiring public-facing business employees to wear face masks during the COVID-19 pandemic.

The expanded language now requires people shopping at essential businesses to cover their nose and mouth with a mask, or scarf at minimum.

Further, he advised customers to enter stores knowing exactly what they need to purchase and to get in and out as quickly as possible.

U.S. Chamber of Commerce to Give $5,000 Grants to Small Businesses

The U.S. Chamber of Commerce launched a fund to provide assistance to small businesses in the form of $5,000 grants.

The Save Small Business Fund — in collaboration with Vistaprint and with support from Merck, S&P Global Foundation, and Travelers — will include contributions from corporations and philanthropies. The grant is expected to address small businesses’ immediate needs such as closures and job loss and will support their long-term recovery.

Applications for the Chamber’s fund will open on April 20, 2020.

In order to qualify a business must:

• Employ between 3 and 20 people

• Be located in an economically vulnerable community

• Have been harmed financially by the COVID-19 pandemic

Leadership Worcester

Now more than ever we recognize that strong local leadership matters as it relates to the health and economic well being of our community.

Now more than ever we recognize that strong local leadership matters as it relates to the health and economic well being of our community.

Whether it is in city or town government or our health care facilities, we are proud that Leadership Worcester graduates have had a positive and profound impact as we navigate the COVID-19 crisis.

One such leader is Dr. Patrick Lowe, a recent graduate of UMassMedical school who immediately entered the front line in the medical fight against this viral enemy. Another, Ariel Lim, in the city’s economic development office, who, with her colleagues, worked tirelessly to create and administer a micro-grant program to help Worcester businesses who are in peril. Another graduate of the program, Neil Rogers and other food service workers in the Worcester Public Schools, have created feeding centers throughout the city to ensure that children have access to healthy meals during this crisis.

These are just a few of the graduates making a difference in our community…and in their workplaces. They, and many others like them, participated in the 10-month Leadership Worcester program.

We must continue to build the next generation of Central Massachusetts leaders. Please consider nominating an employee for this important program, or if you are interest yourself, please consider applying. It will help you, and your organization, to develop the leaders we need.

Learn more about the program and apply by the May 29 deadline.

#20 | Monday, April 13, 2020 | Special Edition Emails Now M-W-F, SBA Loans Processed, Worcester Together, Events

SPECIAL EDITION EMAILS TO PUBLISH ON MON., WED. FRI.

During the past several weeks, the Chamber has worked hard to prepare daily emails to keep members updated. As we adapt to our new normal, information is coming in at a less rapid pace. Beginning this week, emails will be sent on Mon., Wed., and Fri. Rest assured, should any new information need to be communicated immediately, the Chamber will make sure that you receive notification as soon as possible.

SBA LOAN APPLICATIONS BEING PROCESSED, FUNDS EXPECTED IN COMING WEEKS

The PPP authorized up to $349 billion in forgivable loans to small businesses to pay their employees during the COVID-19 crisis. All loan terms will be the same for everyone. Loans will be forgiven as long as:

• The loan proceeds are used to cover payroll costs, and most mortgage interest, rent, and utility costs over the 8-week period after the loan is made; and

• Employee and compensation levels are maintained.

Payroll costs are capped at $100,000 annually per employee. Due to the likely high utilization rate, it is anticipated that not more than 25% of the forgiven amount may be for non-payroll costs.

Loan payments will be deferred for 6 months.

Where can I apply?

Applications are available through any existing SBA lender or federally insured depository institution, federally insured credit union, and participating Farm Credit System institution. Other regulated lenders will be available to make these loans once they are approved and enrolled in the program. Consult with your local lender as to whether it is participating. See a list of SBA lenders.

What do I need to apply?

You will need to complete the Paycheck Protection Program loan application and submit the application with the required documentation to an approved lender by June 30, 2020. Click HERE for the application.

What can I use these loans for?

• Payroll costs, including benefits;

• Interest on mortgage obligations, incurred before February 15, 2020;

• Rent, under lease agreements in force before February 15, 2020; and

• Utilities, for which service began before February 15, 2020.

Economic Injury Disaster Loan Emergency Advance

In response to the Coronavirus pandemic, small business owners in all U.S. states, Washington D.C., and territories are eligible to apply for an Economic Injury Disaster Loan advance of up to $10,000.

This advance will provide economic relief to businesses that are currently experiencing a temporary loss of revenue. Funds will be made available following a successful application. This loan advance will not have to be repaid.

The SBA implemented a $1,000 cap per employee on the advance, up to a maximum of $10,000. So, a business with three employees, for example, would be eligible to receive $3,000 up front.

Eligibility

The SBA’s Economic Injury Disaster Loan provides vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing as a result of the COVID-19 pandemic. This program is for any small business with less than 500 employees (including sole proprietors, independent contractors and self-employed persons), private non-profit organization or 501(c)(19) veterans organizations affected by COVID-19.

To apply for a COVID-19 Economic Injury Disaster Loan and loan advance, click here.

WORCESTER TOGETHER FUND

Seeded with $475,000 from the Greater Worcester Community Foundation in support of organizations disproportionately impacted by the pandemic, the Worcester Together fund is nearing $4 million in donations from the community. THANK YOU!

UPCOMING CHAMBER EVENTS | April 22 to April 29

Sales and Leadership in the Era of Crisis

SPONSORED BY

FREE WEBINAR | How To Succeed with Selling During Uncertainty Wed., April 22, 8:30 am – 9:30 am | REGISTER Designed for business owners, sales leaders, and sales professionals, this webinar will focus on what it takes for you and your team’s sales to be successful during turbulent times. You will learn: Behavior and conversation mapping processes

Remote work environment tips for success

How to stay relevant and have meaningful and purposeful conversations

Wed., April 29, 8:30 am – 9:30 am | REGISTER

Our routines have changed dramatically, our work environments look nothing like they did a month ago, and our companies have had to make some of the toughest decisions in their history.

How leaders handle this crisis determines our future.In this webinar, thoughtful leadership, accountability, and the necessary steps to keep the engines running will be reviewed.

REGISTER – April 29

DURING THIS CRISIS, WEBINARS ARE OPEN TO ALL AT NO COST

ZOOM CALL WITH CONGRESS MCGOVERN | WEDNESDAY, APRIL 15 at 12 NOONREGISTER

UPCOMING CHAMBER EVENTS | April 22 to April 29

Sales and Leadership in the Era of Crisis

SPONSORED BY

FREE WEBINAR | How To Succeed with Selling During Uncertainty Wed., April 22, 8:30 am – 9:30 am | REGISTER Designed for business owners, sales leaders, and sales professionals, this webinar will focus on what it takes for you and your team’s sales to be successful during turbulent times. You will learn: Behavior and conversation mapping processes

Remote work environment tips for success

How to stay relevant and have meaningful and purposeful conversations

Wed., April 29, 8:30 am – 9:30 am | REGISTER

Our routines have changed dramatically, our work environments look nothing like they did a month ago, and our companies have had to make some of the toughest decisions in their history.

How leaders handle this crisis determines our future.In this webinar, thoughtful leadership, accountability, and the necessary steps to keep the engines running will be reviewed.

REGISTER – April 29

DURING THIS CRISIS, WEBINARS ARE OPEN TO ALL AT NO COST

#19 | Friday, April 10, 2020 | PPP loans now available to independent contractors, Healthcare workers needed, Call with McGovern, Webinars

TODAY MARKS THE FIRST DAY SELF-EMPLOYED, INDEPENDENT CONTRACTORS CAN APPLY FOR PPP LOANS

PPP OPENED TO ADDITIONAL EMPLOYMENT CATEGORIES

Today, Friday, April 10 marks the first day independent contractors and self-employed workers can apply for forgivable loans through the Payroll Protection Program – a $349 million segment of the $2 trillion federal CARES Act. Independent contractors receiving 1099-MISC forms and self-employed individuals are eligible to apply for these, potentially 100 percent, forgivable loans.

REQUIREMENT: You must have been in operation on Feb. 15, 2020, your business must have been harmed by the COVID-19 pandemic, and you must submit required documentation along with your loan application.

WHAT DO I NEED TO APPLY? Once you know with which lender you will apply, complete the PPP application and submit with the required documentation to an approved lender by June 30, 2020.